learn about the cost of the plan

On or before Tuesday, November 4, residents will consider two ballot questions.

QUESTION ONE

Question One asks residents to consider an $8.745 million building bond referendum to renovate and expand the Career and Technical Education (CTE) and agriculture shop, add two general education classrooms, renovate and expand the existing kitchen and servery area, and address deferred maintenance items, including renovating the old girls’ and boys’ locker rooms, parking lot improvements, and more.

QUESTION TWO

Question Two asks residents to approve a new, reduced operating levy to maintain our staff, educational programs, and services.

Both questions are non-contingent, meaning either one or both questions can pass without the approval of the other.

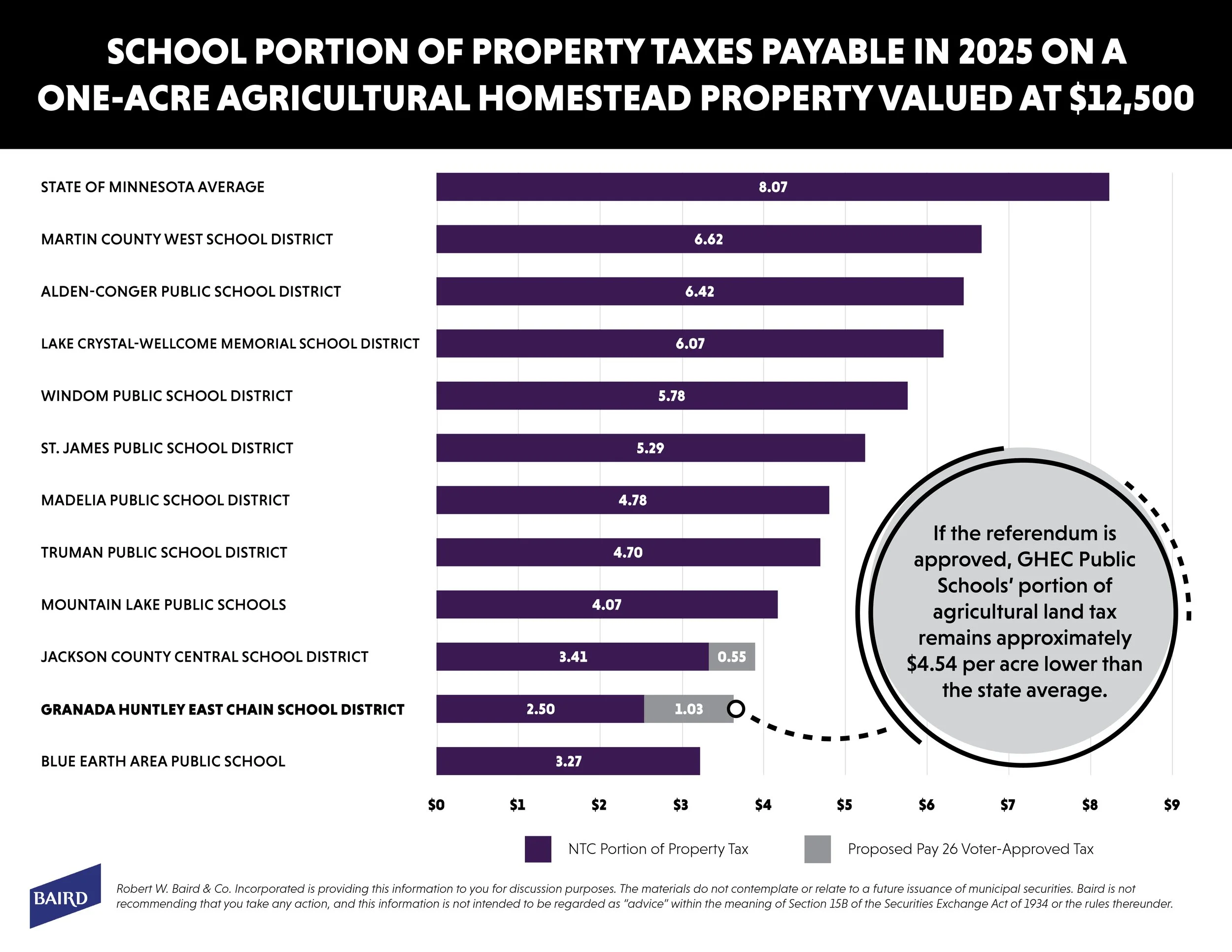

Across the State of Minnesota, facility improvements for public schools are funded through property tax increases. Our district and school board are committed to using taxpayer dollars wisely across all areas, and we have worked hard to ensure the proposed plan reflects residents' priorities and provides high value for taxpayer investment in our school.

If approved by voters, this investment would be supported by a property tax increase. The building bond referendum would take effect in 2026 and expire after 2046 or when the bonds for the project have been paid, whichever happens sooner. The operating levy would take effect in 2027.

How does the plan impact my property taxes?

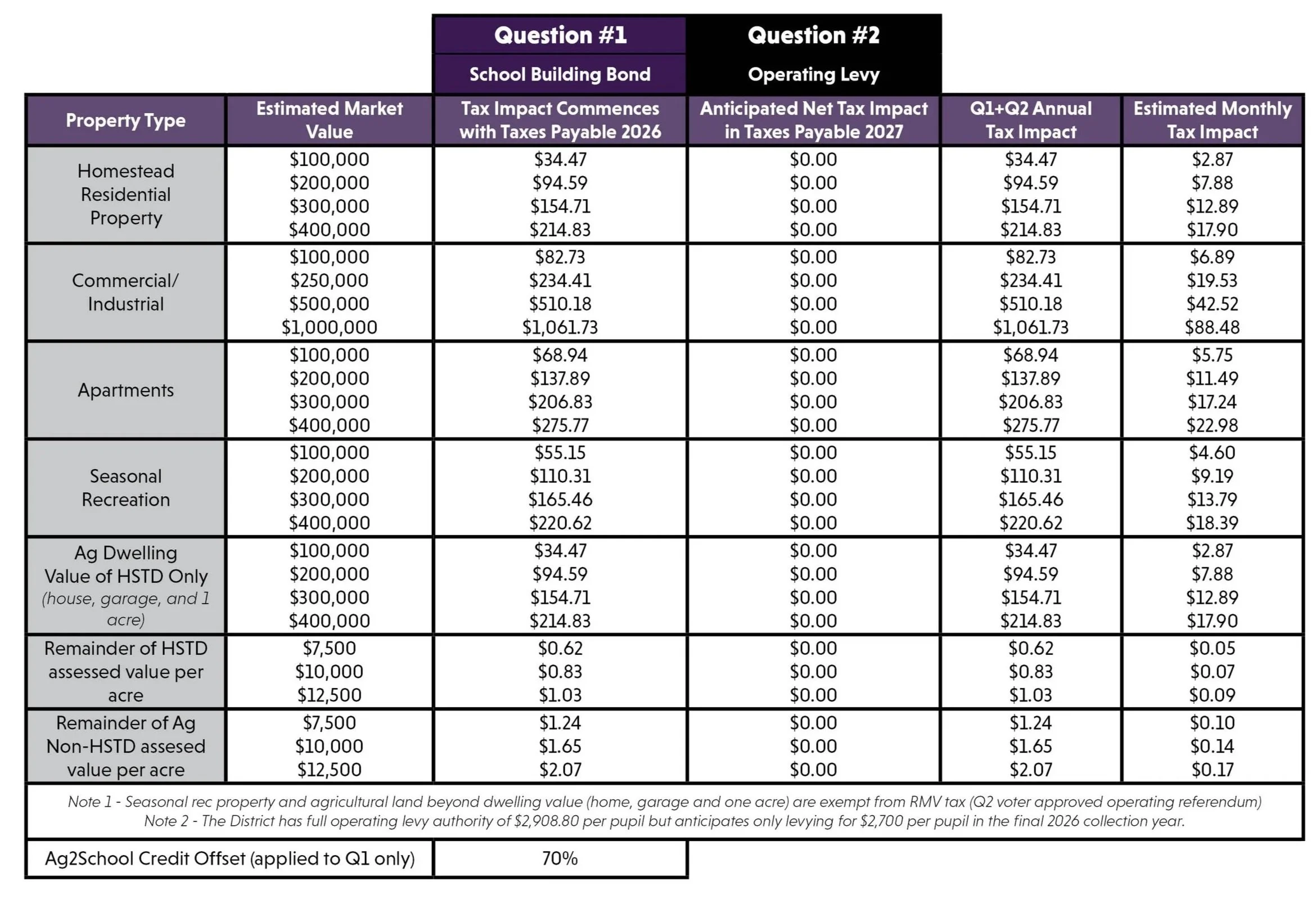

If Question One’s building bond referendum is approved, a $200,000 residential home in the district would see an estimated tax impact of approximately $7.88 per month starting in 2026. For an agricultural homestead with an estimated market value of $10,000 per acre, the estimated tax impact would be $0.07 per acre per month ($0.83 per acre per year) starting in 2026.

Tax impact chart

This table outlines the estimated tax impacts for various property types across the district if the referendum is approved. For easier viewing, click on the image to access a PDF.

If Question Two’s operating levy is approved, residents would see no change in their tax commitment as the levy would continue at the rate of the past few years. The approval would allow for an inflationary adjustment (set by the State of Minnesota) if the school board deemed necessary each year, however, have not required such adjustment for the past several years.

If Question Two is not approved by residents, the school board will use its authority to renew the existing operating levy at its current rate, and school-related property taxes would remain the same. Spending taxpayer dollars wisely is one of the board’s top priorities, and its decision to lower its current operating levy authority means a lower tax impact for residents.

You can calculate your estimated tax impact using our tax calculator here.

Attention agricultural landowners!

The State of Minnesota’s Ag2School Tax Credit is a 70% tax credit provided to all agricultural property except the house, garage, and one acre surrounding the agricultural homestead for building bond referendums. This is not a tax deduction – it’s a dollar-for-dollar credit and is an automatic tax credit paid directly by the state with no application required. This credit would remain at 70% for the life of the bond.

The State of Minnesota’s Ag2School Tax Credit reduces the contribution percentage for agricultural landowners to 24.45%. If approved, approximately 57.04% of the total bond referendum’s principal and interest will be covered by the state’s 70% tax credit. The Ag2School Tax Credit does not apply for operating levies.

Potential Ways to Offset Your Tax Impact

You may be eligible for ways to offset increases to your property taxes from the referendum, including:

Homestead credit refund: the state’s largest property tax refund program.

Special one-year refund: for excessive increases (12% increase and at least $100).

Senior tax deferral: helping those 65+ manage property tax bills.

Renters’ property tax credit: tax relief for renters.

The referendum may make you eligible for these refunds/credits or may increase the amount from any refunds/credits you already receive. In addition, an increase in property taxes may be deductible on your federal tax return if you itemize deductions.

The Homestead Credit Refund program began in 1967 and today is received by over 500,000 Minnesota homeowners. Homestead Credit Refunds are provided on a sliding scale and based on your household income and property tax bill. The refund increases as your property taxes increase, up to as much as $3,310 each year.

Excess property taxes: Refunds will range from 53% to 88% of the excess property tax you pay, as determined by a state formula based on income.

What is the Homestead Credit Refund?

Your total household income is less than $139,320.

You are a Minnesota resident for at least half of the year.

You owned or occupied your home as of January 2, 2025.

Your property is classified as your homestead.

You have no delinquent property taxes.

As many as 65% of homeowners statewide may be eligible for annual state property tax refunds if property taxes make up more than 1% to 2.5% of household income (a threshold that adjusts based on that income). If eligible, you may apply for the Homestead Credit Refund by mailing in the paper M1PR form or via the Minnesota Department of Revenue’s website.